Pallone, Pascrell Introduce Bipartisan Flood Insurance Legislation

The legislation takes action against skyrocketing premiums

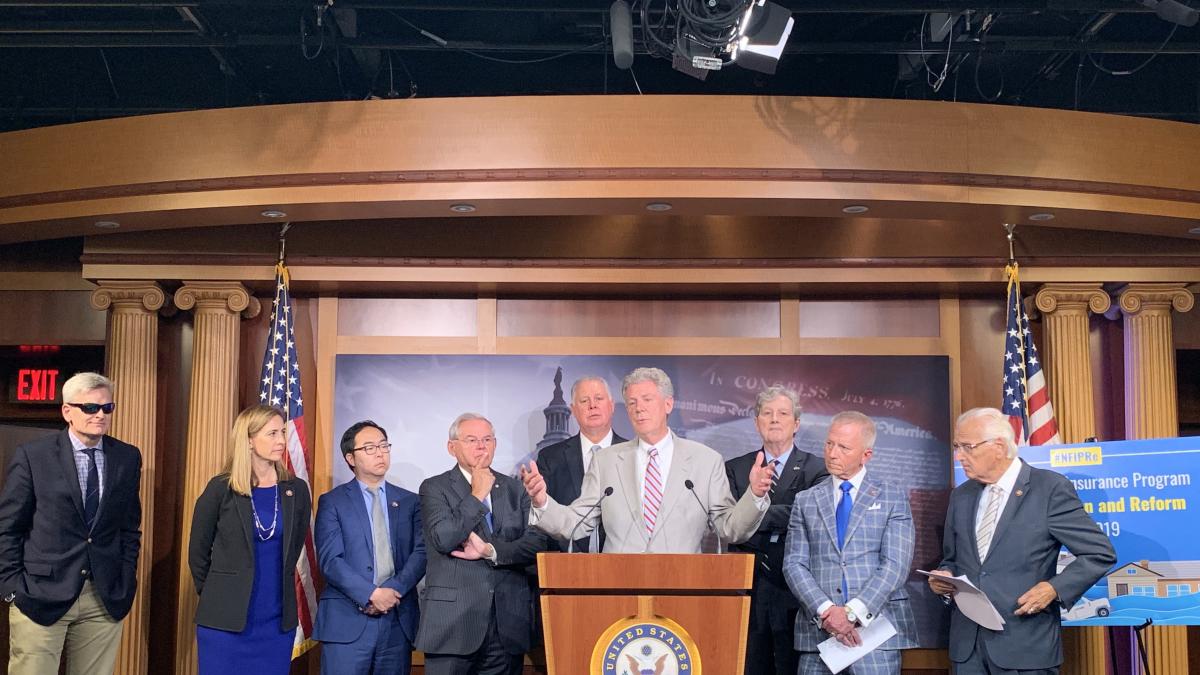

Washington, D.C. – Today, Congressman Frank Pallone, Jr. (D-NJ-06), Congressman Bill Pascrell, Jr. (D-NJ-09), and Congressman Clay Higgins (R-LA-03) announced the National Flood Insurance Program Reauthorization and Reform (NFIP Re) Act of 2019. The bill protects policyholders from steep premium increases and reauthorizes the NFIP for five years. It also makes the program more affordable, creates greater transparency, and injects fairness into the claims process. Senator Bob Menendez of New Jersey and Senators Bill Cassidy and John Kennedy of Louisiana will introduce a companion bill in the Senate.

"My constituents know all too well that a fair flood insurance program is critical for rebuilding in the wake of destructive storms. After Superstorm Sandy, insurance companies outright refused to make good on their promises to policyholders and instead pointed to the fine print while denying families who had lost everything. New Jerysans deserve a long-term flood insurance program reauthorization that improves the program based on the realities of major weather events like Sandy," Congressman Pallone said. "This legislation will go a long way to strengthen our flood insurance program so that homeowners in my district are protected from the devastating effects of future flooding."

"I remember touring the devastation of Sandy like it was yesterday. Homes damaged. Businesses destroyed. The mold. The sand. The debris. I spoke with my constituents who saw their entire lives swept away in an instant. I vowed that day never to stop fighting for them," said Congressman Pascrell. "Our bipartisan, bicameral legislation will do a lot. Thanks to the hard work of Senator Menendez and Congressman Pallone, our bill helps people prepare prior to a storm with accurate maps and flood prevention investments. It strengthens the claims process so survivors get what they need to rebuild. It gives affordability safeguards to stop premiums from being jacked up. And it brings much-needed accountability to the Write Your Own program. We will be fighting hard to make sure we pass these changes into law. We owe it to Sandy victims."

"Home and business owners in South Louisiana and across the country rely on the NFIP to protect their property and provide affordable flood insurance. A long-term reauthorization, in the form of the National Flood Insurance Program Reauthorization and Reform Act of 2019, will provide policyholders with greater certainty and allow necessary reforms to improve the program," Congressman Higgins said. "The National Flood Insurance Program Reauthorization and Reform Act of 2019 protects affordability, prioritizes pre-disaster mitigation, improves flood plain mapping, and ensures long-term sustainability. Our legislation has bipartisan support from many coastal lawmakers, and I want to thank Congressman Pallone for his continued work on this issue."

"We've witnessed the NFIP fail our constituents in their greatest hour of need and, after countless reauthorizations that simply kick a broken can down the road, we want real reform," said Senator Menendez. "With the National Flood Insurance Reauthorization and Reform Act of 2019, we can make the program more sustainable, more affordable, hold FEMA and private contractors accountable, and invest in the kind of forward-looking mitigation that reduces risk and prevents costly flooding in the first place."

Comprehensive flood insurance that lowers premiums will provide peace of mind for New Jerseysans.

"The only way I could have afforded to mitigate my home was from the grant money from Superstorm Sandy and the increased cost compliance from my flood insurance. Before the storm I was paying close to $2000. A year and once I elevated it went down to $300 a year. More importantly, I will no longer have to worry that my house will be flooded again," said Jody Stewart.

"I am a Sandy survivor who is still not home. Because of the supplemental fund, we are getting closer, but that day still hasn't come yet. We know that for every dollar we towards mitigation we save $4-6 on disaster recovery costs. Had we been able to elevate our home before Sandy, our home wouldn't have been damaged. Making sure that funding is accessible and sufficient means we can be better prepared for the next storm. And there will be another storm, it's just a question of when and if we have applied lessons learned from Sandy," said Nancy Caira.

"When my home was destroyed by hurricane Sandy, I had the maximum legal amount of flood insurance I could buy - $250,000. Yet still, almost 7 years later I am not home. My WYO insurance company paid me 37 cents on the dollar, using a controversial engineering firm to falsely claim damage was pre-existing and caused by ‘earth movement' instead of the three feet of water that flooded my home. The National Flood Insurance Program desperately needs to be fixed. We need premiums that we can afford, protection from unscrupulous lawyers, and engineers who work for the program, penalties for insurance companies who underpay victims, and attorney fee shifting so consumers who are forced to sue don't have to lose one-third of the money needed to rebuild to legal fees.We are counting on our elected officials to produce legislation that will accomplish meaningful reform that represents the best interest of American consumers instead of the insurance companies," said Doug Quinn.

The National Flood Insurance Program Reauthorization and Reform Act of 2019 would take concrete steps to improve affordability and accountability in the National Flood Insurance Program by implementing the following policies:

- Reauthorizes NFIP for five years, extending the program until September 30, 2024.

- Lowers the cap on allowable annual premium increases on NFIP policies to ensure affordability each year for policyholders.

- Caps Write Your Own (WYO) compensation at 22.46% to ensure private insurance isn't making hand-over-fist profits at the expense of program sustainability.

- Institutes a significant number of policyholder protection and fairness provisions to ensure homeowners who faithfully paid their premiums are treated fairly during the claims process.